RaceRanger Seed Round

RaceRanger and the Offer

RaceRanger is an electronic sensor system designed to improve fairness around the issue of drafting on the bike section of non-drafting triathlons. Currently, determination of drafting distances by athletes and the technical officials policing them are made with subjective naked eye judgements.

Developed by two triathletes from New Zealand, in collaboration with the World Triathlon Sport department, RaceRanger comprises two electronic units that triathletes in non-drafting competitions attach to their bicycles, one at the front and one at the rear.

The system makes accurate measurements of the distance between athletes while they ride. The rear unit features 3 coloured lights that signal backwards to a following competitor, providing information about their following distance. In future, the system will detect when infringements are occurring and send this data to technical officials patrolling the course, via a tablet app interface. The official will assesses the situation in real-time and can then make a decision on whether a penalty needs to be applied through the system.

All athletes in a triathlon are given two devices to mount on the front fork and rear seat post of their bikes. RaceRanger’s initial business model is to manufacture and retain ownership of the devices, delivering the anti-drafting service (hardware as a service) at events around the world. This is the same model that the companies providing timing services currently operate. Event companies will be charged on a per athlete, per use basis. The event companies will on-charge the fee to athletes as part of the event entry fees, with the potential to add their own margin. Entry fees currently average US$540 for typical Ironman or Ironman 70.3 events.

Live athlete tracking will be developed in 2023, allowing for an improved spectator experience in following their spouse or friend around the course.

RaceRanger is seeking investment of NZ$1M for equity; on a NZ$3.5M pre-money valuation. Funds raised will be used to develop the live athlete tracking and motorbike drafting monitoring features, and a further hardware refinement round in preparation for manufacturing at a larger scale. Use in the pro cycling peloton and integration with virtual training platforms such as Zwift will be explored and pursued as high priorities yet longer-term targets.

The Information Memorandum for Race Ranger can be found below:

2023 RaceRanger Investment Memorandum

Lighthouse Digital

Lighthouse Digital Story

LHD Group Limited (“LHD Group” or “the Company”) was formed in 2019 through several acquisitions to secure a position in the rapidly growing digital marketing segment in New Zealand.

Those acquisitions comprised Lighthouse Digital Limited (“Lighthouse Digital”), a progressive and growing digital signage and marketing agency and in a separate transaction LHD Group also acquired 20 large outdoor Digital Billboards. These businesses collectively now trade as Lighthouse Digital.

Lighthouse Digital was established in February 2018, providing digital marketing solutions to businesses in niche markets, using Digital Signage as a medium and has a dominant position in a number of market segments with its Media TV product. MediaTV focuses on the marine sector via MarinaTV, GardenTV (in conjunction with Palmers Garden Centres), TradeTV (with selected ITM and DIY businesses) and ClubTV (in conjunction with RSAs and large clubs) along with CaféMedia, a digital signage software service. Lighthouse Digital now has 400+ customers all in need of one or more of its services and more than 105 Media TV screens and 20 Digital Billboards deployed in the upper north island.

Lighthouse Digital is an “end-to-end” provider of Digital Marketing, Digital Signage and digital advertising products and services. The business model and strategy is based on expanding the digital signage network, making sales of advertising onto its network, and providing more recently developed services, such as Digital Signage software, and Digital Marketing resulting in long term, renewable and/or recurring revenue streams.

The result is a rapidly growing network of digital assets, and an increased range of marketing products that are available to Lighthouse Digital’s customer base.

Strategy

The businesses strategy is to expand Lighthouse Digital’s Digital Billboard and MediaTV base as well as expand into additional services that provide the customer with a one-stop-shop. Additionally Lighthouse Digital has identified an opportunity to develop international markets and provide Software as a Service (“SaaS”) Digital Signage screen management systems via our Lightsignz product.

To implement this strategy, Lighthouse Digital is raising up to $2m of new equity capital to fund growth with a plan to list on the New Zealand based Unlisted Securities Exchange (“USX”).

THE OFFER

The details of the offer and the Information Memorandum can be found below.

| Minimum target: | $250,000 | Maximum target: | $2,000,000 | |

| Equity % (fully diluted): | 9.5% | Equity % (fully diluted): | 45.5% | |

| Pre-money valuation: | $2,395,157 | |||

| Minimum investment: | 1,000 shares | |||

| Share price: | $0.50 per share | |||

| Maximum shares offered: | 4,000,000 |

This Information Memorandum is a key document in relation to this offer. We recommend you read it prior to making your decision to invest. It includes important information about the offer.

LHD Group’s constitution is available here

IMPORTANT DISCLOSURE

Armillary Private Capital

LHD Group is a client of Armillary Private Capital which has provided and continues to provide certain services to it. Armillary Private Capital will receive some of the fees to be paid by LHD Group to Crowdsphere upon the successful completion of this capital raising. Armillary Private Capital is the manager of Crowdsphere and related parties hold a significant shareholding in Crowdsphere.

Parties related to Armillary Private Capital are shareholders in LHD Group.

David Wallace is a director of LHD Group. He is also a director of Armillary Private Capital and Crowdsphere.

Secondary Market

The Company has applied to have its shares quoted on the Unlisted Securities Exchange (USX) upon the successful completion of this capital raising. Investors should note the Armillary Private Capital, which is the manager of Crowdsphere, is also the manager of Efficient Market Services Limited which trades as the USX.

Armillary Private Capital, and/or its related parties do not have an ownership interest in Efficient Markets Services Limited.

If you have any questions regarding this offer please contact Lighthouse Digital at [email protected] or call +64 9 558 3958; or Crowdsphere at [email protected] or call +64 9 280 3161.

Lateral Profiles – Private Offer

Lateral Profiles and the Offer

Lateral Profiles is at the forefront of the most significant revolution in digital and mobile technology combining HTML5 and Direct Carrier Billing. Lateral accesses a global market of all mobile phone accounts.

Lateral Profiles platform, Viaduct, has been specifically developed to target this market and has been tested with successful products and carriers. Lateral Profiles now has a multi-territory agreement with Docomo Digital, NTT Docomo’s global DCB subsidiary.

Lateral Profiles platform, Viaduct, has been specifically developed to target this market and has been tested with successful products and carriers. Lateral Profiles now has a multi-territory agreement with Docomo Digital, NTT Docomo’s global DCB subsidiary.

You must be logged in to view this content.These are the key documents in relation to this offer:

- Investment Memorandum

- Letter to shareholders – 3 October 2017

- Update from CEO to shareholders – 20 October 2017

- Company Constitution

- Investment forms – paper versions (click here if you wish to print out the investment form and send via post)

Offer details

| Minimum target: | $150,000 | Maximum target: | $500,000 | |

| Equity %: | 6.79% | Equity %: | 19.53% | |

| Pre-money valuation: | $2,059,578 | |||

| Minimum investment: | $1,000 (25,000 shares) | |||

| Share price: | $0.04 per share | |||

| Maximum shares offered: | 12,500,000 |

The offer will be required to meet the minimum investment target of $150,000 for it to be deemed as successful, this means the funds will be collected and shares issued by Lateral Profiles.

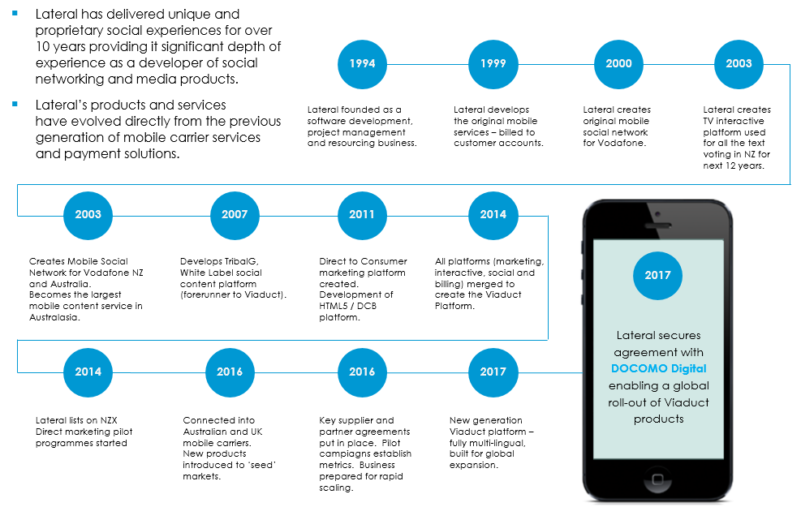

Lateral Milestones

How to access the offer via this website

The offer can be subscribed only through this site, if you have any questions regarding this process please contact either Crowdsphere or Lateral via the details below.

- If you do not have an account you will need to create an account via ‘Create Account’ at the top of this screen

- Once you have created an account and are successfully logged in you can click ‘INVEST NOW’ on this page

- Enter the dollar amount you wish to invest in the ‘Total $’ box. The minimum is $1,000

- Confirm your investment on the following screens, you will receive an email which will request personal details from you

Contact information

Syft Technologies – Private Offer

This offer is made to existing shareholders of Syft Technologies Limited in conjunction with a private placement of up to $7.5m fully underwritten by an existing shareholder of Syft Technologies. Shareholders will be offered to subscribe to a maximum of $1.9m of ordinary shares at a price of $1.15 per share subject to scaling the offer if an oversubscription occurs.

Shareholders can apply for as many shares as they wish through this crowdfunding offer.

The following conditions apply in regards to the number of shares offered through Crowdsphere:

- If the private placement raises $6.5m or more the maximum amount offered through Crowdsphere will be $1.0m; and

- If the private placement raises less than $6.5m the amount raised through Crowdsphere will be increased to bring the total capital raise up to $7.5m to a maximum of $1.9m.

Under no circumstances will the Crowdsphere offer exceed $1.9m.

The details of the offer and key documentation can be found below. If you have any questions regarding this offer please contact Crowdsphere at [email protected] or call +64 9 280 3161.

| Minimum target: | $1,150 | Maximum target: | $1,900,000 | |

| Equity %: | 0.001% | Equity %: | 2.50% | |

| Pre-money valuation: | $74,237,102 | |||

| Minimum investment: | 1,000 shares | |||

| Share price: | $1.15 per share | |||

| Maximum shares offered: | 1,652,174 |

These are the key documents in relation to this offer:

- Investment Memorandum

- Company Constitution

- FY17 Annual Report

ZAVY

| Minimum target: | $250,000 | Maximum target: | $650,000 | |

| Equity %: | 11.11% | Equity %: | 24.53% | |

| Pre-money valuation: | $2,000,000 | |||

| Minimum investment amount: | $1,000 | |||

| Share price: | $2 per share | |||

| Maximum shares offered: | 325,000 |

The proliferation of the social and digital channels has changed the way brands are built. Brands are now built ‘bottom up’ as much as ‘top down’ across a huge range of fragmented interactions. Global ad spend on social media is expected to exceed US $20B in 2016 (5 yr CAGR of >30%), while traditional media ad spend continues to decline.

The introduction of operational social media tools has not uncovered brand equity building social media practices.

Zavy is a software as a service (SaaS) platform that helps businesses grow better brands in social media and digital. Using proprietary algorithms and analytics, Zavy shows users how their organisation is performing in real time. With class leading breath of data capture, Zavy creates an overall view of brand performance in social and digital down to diagnosing post by post performance. The exceptional user interface provides ‘point and click’ simplicity without compromising the clarity of insight.

Zavy wants to be the global leader in social media analytics, this is a market that is worth more than $1b USD per annum. The company is forecast to have over 70 customers by FY18 and have EBIT of $936K. The capital raised will be used to build the sales and marketing resources, development and establish more resellers internationally.

Zavy is looking to raise between $250k and $650k of new equity capital to accelerate growth, this represents between 11.11% and 24.53% post money ownership.

Zavy Blog: Posting relevant articles, news and blog posts

ComputerWorld article: NZ tech start-up signs deal to access Facebook topic data to lift digital brand performance (May 2016)

bizEDGE article: Kiwi tech company Zavy wins contract to analyse aggregated Facebook data (May 2016)

TRA blog post: Datasift & New Zealand tech start-up Zavy sign deal to access Facebook topic data to lift digital performance of brands (May 2016)

TRA blog post: Introducing our new tool Zavy (May 2016)

StopPress article: Zavy signs deal with DataSift, accesses Facebook user data to help brands (May 2016)

Stuff article: Mike O’Donnell: Zavy might have saved Chiefs from online trouncing (August 2016)

Radio Live interview with Vaughan Davis (September 2016)

Noted – Elegant EMR

| Minimum target: | $300,000 | Maximum target: | $800,000 | |

| Equity %: | 23.50% | Equity %: | 45.10% | |

| Pre-money valuation: | $975,000 | |||

| Minimum investment amount: | $10,000 | |||

| Share price: | $1 per share | |||

| Maximum shares offered: | 800,000 | |||

NB: To limit the number of shareholders in the company, this raise is being limited to 33 backers. Once there are 33 backers the campaign will close.

THE PROBLEM: Currently, health providers are expected to do more with less, while increasing productivity and providing patient-centred care. This is against a backdrop of an aging population and treatments of increasing complexity.

Health practitioners are also more accountable than ever, both to patients and funders. To successfully apply for funding and allocate resources, quality health data, including outcomes and population health data, are critical.

Against this background, most medical practitioners (who aren’t still using paper notes), are working on legacy EMR systems that do not work in a manner that it is practical and intuitive to the user.

THE SOLUTION: Noted™ is a cloud-based Electronic Medical Record (EMR) and Health Practice Management system that is easy to use. It will provide a unified system for the entire range of community-based medical practice, including allied health, general practice, medical specialties and aged and residential care.

Noted provides for fast, accurate, detailed entry of clinical notes that are quick and easy to review, in a mobile friendly, cloud-based system. It will allow for secure sharing of health data between practitioners, health sectors and patients. Notes are stored centrally in a way that enables fine-grained data to be queried and analysed at the level of individual practitioner, clinic or population.

The software as a service (SaaS) product will be available on a monthly subscription basis with a monthly fee of between $50 and $100 per concurrent user, depending on user type and requirements.

Contact Details

Scott Pearson – Founder | CEO